Basic ID setup

Before setting up the basic ID needed for the export of the tax audit file you need to have installed the Norwegian version. At the Head office (or the main Site Manager connected to the main data source) you need to install the Site Manager plugin that comes with the Norwegian version. See Install Norwegian version if you have not done this already.

When you have installed the Site Manager plugin you have a new button in your ribbon: Setup > [Fiscalization] Basic ID

The user needs to have the Manage fiscalization settings permission.

Configuring the basic ID

The installation of the Norwegian version has set the basic ID for all fixed information and operations such as the transaction code. But for the retail departments, sales tax codes and payment methods which are created in the Site Manager you will need to set the basic ID's manually.

Here you can see the list of all codes: Norwegian SAF-T Cash Register - Code lists

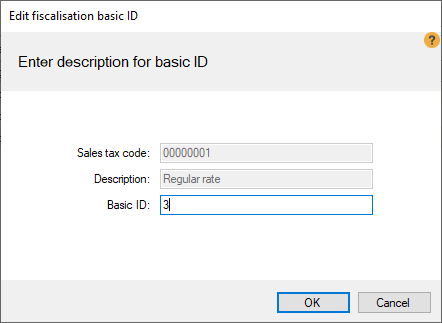

Sales tax codes

- Go to Setup > [Fiscalization] Basic ID > Sales tax codes tab

- Edit each of the Sales tax lines by double clicking the line or pressing the edit

button.

button. - In the Edit fiscalization basic ID dialog enter the correct basic ID for the tax rate.

- Press the OK button

| Id | Tax code | Percent |

| 3 | Regular rate | 25 |

| 31 | Reduced rate, middle | 15 |

| 32 | Reduced rate, raw fish | 11 |

| 33 | Reduced rate, low | 10 |

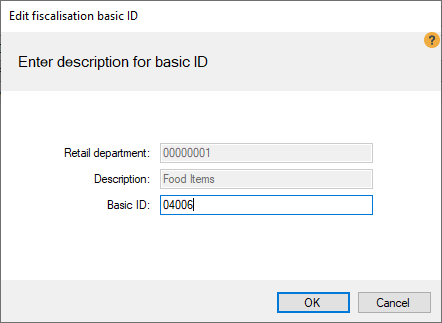

Retail departments

According to the regulations article group codes have some predefined Basic IDs that need to be assigned to your LS One retail departments depending on what type of items are in each department.

- Go to Setup > [Fiscalization] Basic ID > Retail department tab

- Edit each of the retail department lines by double clicking the line or pressing the edit

button.

button. - In the Edit fiscalization basic ID dialog enter the correct basic ID for the tax rate.

- Press the OK button

See the all article group codes in this document: Norwegian SAF-T Cash Register - Code lists

| PredefinedBasicID-04 | English name | Norwegian description |

| 04001 | Withdrawal of treatment services | Uttak av behandlingstjenester |

| 04002 | Withdrawal of goods used for treatment services | Uttak av bhanlingsvarer |

| 04003 | Sale of goods | Varesalg |

| 04004 | Sale of treatment services | Salg av behanlingstjenester |

| 04005 | Sale of haircut | Salg av hårklipp |

| 04006 | Food | Mat |

| 04007 | Beer | Øl |

| 04008 | Wine | Vin |

| 04009 | Liquor | Brennevin |

| 04010 | Alcopops/Cider | Rusbrus/Cider |

| 04011 | Soft drinks/Mineral water | Mineralvann (brus) |

| 04012 | Other drinks (tea, coffee etc) | Annen drikke (te, kaffe etc) |

| 04013 | Tobacco | Tobakk |

| 04014 | Other goods | Andrevarer |

| 04015 | Entrance fee (cover charge) | Inngangspenger |

| 04016 | Fee entrance (members etc) | Inngangspenger fri adgang (uten vederlag) |

| 04017 | Cloakroom fee | garderobeavgift |

| 04018 | Free cloakroom | Garderobeavgift fri garderobe (uten vederlag) |

| 04019 | Accomodation - full board | Helpensjon: Overnattning med frokost, lunsh og middag |

| 04020 | Accomodation - half board | Halvpensjon: Overnatting med frokost og middag. |

| 04021 | Accomodation - With breakfast | Overnatting med frokost |

| 04999 | Other | Øvrige |

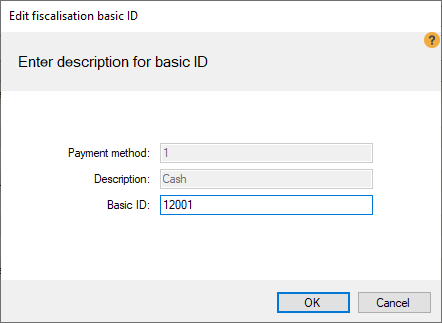

Payment methods

The different payment methods that you accept at your store need a predefined basic ID.

- Go to Setup > [Fiscalization] Basic ID > Payment method tab

- Edit each of the payment method lines by double clicking the line or pressing the edit

button.

button.

- In the Edit fiscalization basic ID dialog enter the correct basic id for the tax rate.

- Press the OK button

| PredefinedBasicID-12 | English name | Norwegian description |

| 12001 | Cash | Kontant (alle typer valuta) |

| 12002 | Debit card | Bankkort (debet kort) |

| 12003 | Credit card | Kreditkort |

| 12004 | Bank account | Bankkonto |

| 12005 | Gift token | Gavekort |

| 12006 | Customer card | Kundekonto |

| 12007 | Loyalty, stamps | Lojalitetspoeng |

| 12008 | Bottle deposit | Pant |

| 12009 | Check | Sjekk |

| 12010 | Credit note | Tilgodelapp |

| 12011 | Mobile phone apps | Mobiltelefon løsningar, ulike betalnigsapplikasjoner |

| 12999 | Other | Øvrige |

See the all payment codes in this document: Norwegian SAF-T Cash Register - Code lists

New table FISCALBASICID was created to store basic ID for Sales tax code, Retail departments and Payment methods, into FISCALID field.